The term ‘creative industries’ has newly developed during the last 10 or 15 years, while its components already existed in the economic system since decades. Partly, the term is synonymously used as ‘creative economy’ or ‘cultural industries.’

Creative industries in Germany comprise – similar to the UK (Parry 2013) – a broad range of different sub-segments, including music industry, book trade, arts and antique markets, film industry, television and radio, performing arts, design (including fashion), architecture, press, advertising, software and games industry, and other (Söndermann 2009). This definition was adopted by the German Conference of Economics Ministers in 2009 (GCEM 2009). All mentioned sub-segments have in common that they are aiming at an economic profit by creating, producing, distributing or broadcasting cultural or creative goods and/or services. Creative labor is regarded as connecting core element of all sub-segments of creative industries (Söndermann 2012).

Currently, creative industries in Germany play an important role not only as pioneer for a knowledge-based economy, but also as reputation factor for cities and regions as well as independent dynamically growing economic sector of national relevance. In the year 2010 there were about 240,000 enterprises with a total of nearly 960,000 jobs in Germany, generating a turnover of EUR 137 billion (Arndt et al. 2012).

This paper intends to give an outline on the historical development and the current status of creative industries in Germany considering recent policies supporting creative industries. Furthermore, key factors for the development of creative industries under conditions of Germany are highlighted. The paper concludes with new ideas for supporting the impact of Science and Technology Parks on creative industries.

From a methodological point of view the paper is a compilation of several empirical research studies based on a literature review. Nevertheless the character of the conclusions is more descriptive and hermeneutic.

2. DEVELOPMENT AND STATUS OF CREATIVE INDUSTRIES IN GERMANY

Creative industries in Germany have continuously developed since the year 2000. While the number of enterprises has increased from about 186,000 in 2000 (Fesel and Söndermann 2007) to about 240,000 in 2010 (Arndt et al. 2012), the turnover has changed from about EUR 127 billion in 2000 (Fesel and Söndermann 2007) to about EUR 137 billion in 2010 (Arndt et al. 2012).

In the year 2011 the number of labor force has passed 984,000, excluding about 710,000 insignificant or marginal employments (Söndermann 2012).

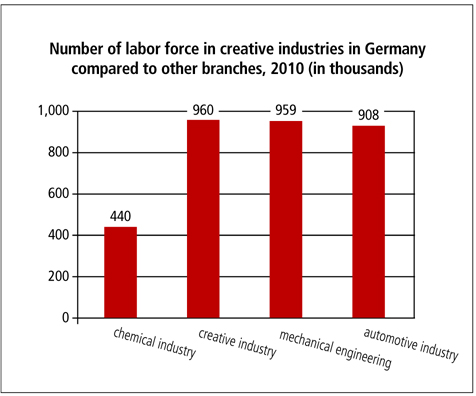

Creative industries in Germany have generated a gross value added of about EUR 63 billion in 2011 (Söndermann 2012), starting from EUR 58 billion in 2004 (Fesel and Söndermann 2007). This is about 2.4 % of the German gross domestic product (Söndermann 2012). Even compared to other branches the contribution of creative industries in Germany is considerable. <Fig. 1> points out the number of labor force in creative industries in 2010 in Germany in comparison to chemical industry, mechanical engineering, and automotive industry. In that time in the creative industries sector were about 960,000 labor forces, which is not a significant difference to mechanical engineering. Interestingly, with 908,000 the number of labor force in the automotive industry was somewhat lower than in the creative industries. In contrast to this with only 440,000 labor force in the chemical industry the correspondent figure of the creative industries is more than twice of that (Söndermann 2012).

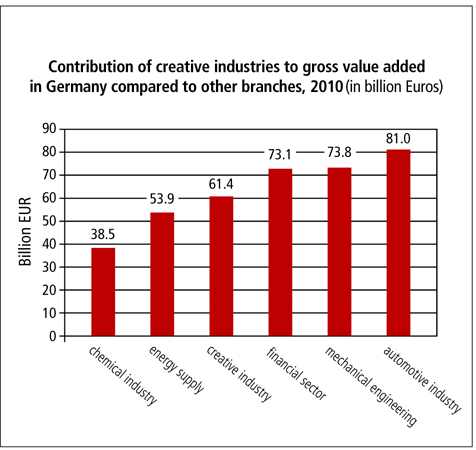

<Fig. 2> illustrates the contribution of creative industries to gross value added in Germany during the year 2010, compared to other branches. With EUR 61.4 billion the creative industries rank between chemical industry (EUR 38.5 billion) and energy supply (EUR 53.9 billion) on the one hand and the financial sector (EUR 73.1 billion), mechanical engineering( EUR 73.8 billion), and automotive industry (EUR 81.0 billion) on the other hand (Söndermann 2012). Taking into account that financial sector, mechanical engineering and automotive industry in Germany are highly developed; the figures indicate the significance of creative industries as another important economic sector.

In relation to other large Europe countries, such as UK, France, Italy or Spain, presented figures indicate medium conditions for Germany. According to (HKU 2010) core activities of creative industries in UK amount to 6.2 % of the GDP, while it is in France 4.9 %, in Germany 4.2 %, in Italy 3.8 %, and Spain 3.6 %. Corresponding to these findings, core activities of creative industries represent 5.4 % of all jobs in UK, 4.1 % in Germany, 3.7 % in France, 3.6 % in Italy, and 3.5 % in Spain (HKU 2010).

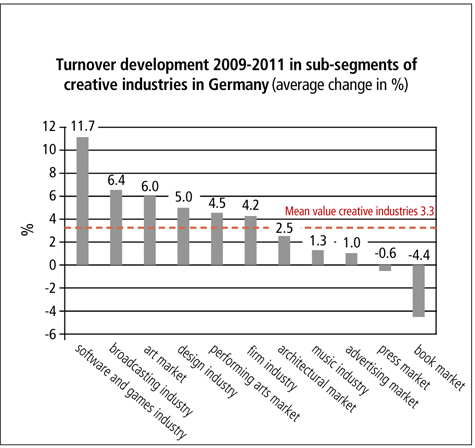

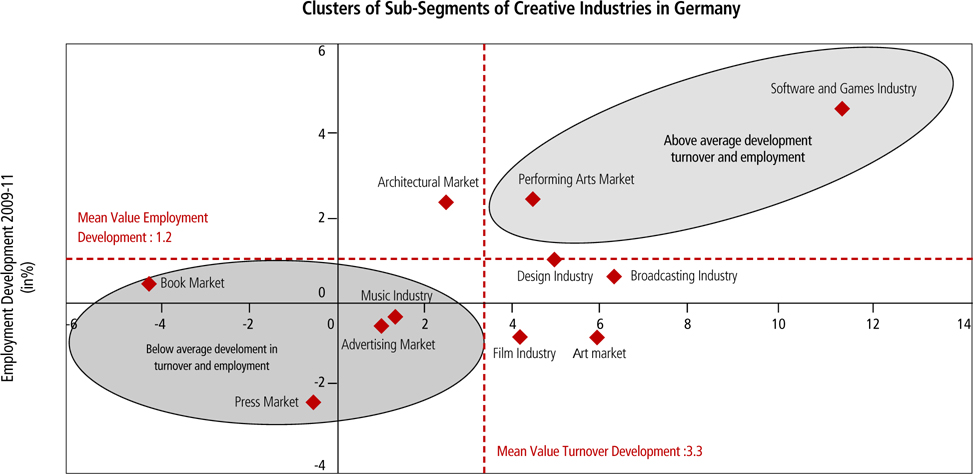

Since there is a general positive trend of the development of creative industries in Germany in the last years measured by appropriate economic key indicators, the question arises, whether or not there is a homogenous development in all different sub-segments or not. <Fig. 3> based on recent data from Söndermann (2012) reveals that the average change of turnover development in the sub-segments of creative industries in Germany from 2009 to 2011 was not homogenous. Firstly, there is a strong variation between the sub-segments of creative industries in Germany, varying from +11.7 % (software and games industry) to +4.4 % (book market). Secondly, most sub-segments underlie a generally positive development, including advertising market (+1.0 %), music industry (+1.3 %), architectural market (+2.5 %), film industry (+4.2 %), performing arts market (+4.5 %), design industry (+5.0 %), art market (+6.0 %), broadcasting industry (+6.4 %), and the above mentioned software and games industry, which is the market leader with +11.7 %. There are only two sub-segments with negative trend, namely press market (-0.6 %), and book market (-4.4 %). Thirdly, there are 6 sub-segments above the mean value of creative industries (+3.3 %), including film industry, performing arts market, design industry, art market, broadcasting industry, and software and games industry, while 5 sub-segments are characterized by a development below average, comprising architectural market, music industry, advertising market, press market, and book market.

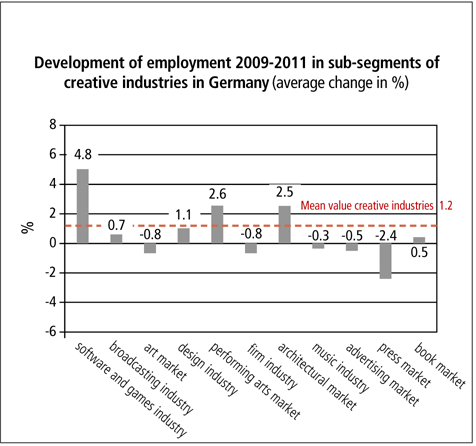

Another important factor is the development of employment within the different sub-segments. As it is shown in <Fig. 4> according to Söndermann (2012), the development in the sub-segments of creative industries in Germany from 2009 to 2011 is varying from +4.8 % (software and games industry) to -2.4 % (press market). Six sub-segments underlie a positive development, including book market (+0.5 %), broadcasting industry (+0.7 %), design industry (+1.1 %), architectural market (+2.5 %), performing arts market (+2.6 %), and the software and games industry, which is the market leader with +4.8 %. There are five sub-segments with negative trend, namely music industry (-0.3 %), advertising market (+0.5 %), film industry (-0.8 %), art market (-0.8 %), and press market (-2.4 %). There are only 3 sub-segments above the mean value of creative industries (1.2 %), including software and games industry, performing arts market, and architectural market, while 8 sub-segments are characterized by a development below average, comprising broadcasting industry, art market, design industry, film industry, music industry, advertising market, press market, and book market. Furthermore, it is worth mentioning that there is no direct connection between the turnover development, pointed out in <Fig. 3>, and the development of employment, presented in <Fig. 4>. This is highlighted in <Fig. 5>.

According to <Fig. 5> we can conclude that only two subsegments in the creative industries in Germany have positively developed during 2009-2011 in terms of an above average development of turnover and employment: the software and games industry as well as the performing arts market. The architectural market is characterized by an above average development of employment, despite of a below average development of turnover. Another group of sub-segments is characterized by a below average development of employment, despite of an above average development of turnover. This group comprises the sub-segments design industry, broadcasting industry, film industry, and art market. Finally, there is group of sub-segments which is characterized by a below average development 2009-2011 concerning both criteria turnover and employment: the book market, the music industry, the press market, and the advertising market. In turn, that means, in the last few years driving forces of creative industries in Germany have only been the sub-segments of software and games industry as well as the performing arts market.

Arndt et al. (2012) have pointed out that creative industries “not only possess strong innovation potentials themselves, but they also function as an important catalyst for innovations and knowledge-based growth in numerous other economic fields.” The way how this works or should work in practice was described by the same authors as follows: 1. “Cultural and creative industries are innovative and pioneering in their use of new kinds of methods and forms of working.” 2. “Enterprises from cultural and creative industries make great use of non-technical innovations and are thus broadening the innovation system characterised by technical advances.” 3. “Cultural and creative industries drive innovations in other sectors and contribute to improving the competitiveness of the economy as a whole due to their strong orientation towards innovations.” 4. “Cultural and creative industries make the innovations of other sectors applicable and marketable by creating new user experiences and emotionalising products and services.” 5. “In order to increase the exploitation of previously untapped innovation potentials, cultural and creative industries need to become more visible to enterprises from other sectors.”

3. RECENT POLICIES SUPPORTING CREATIVE INDUSTRIES IN GERMANY

Currently, there are different approaches in Germany aiming at supporting creative industries.

Firstly, there have been bottom up initiatives in certain German cities and regions, especially federal states, from the very beginning. North Rhine-Westphalia was the first German federal state, which started an initiative for creative industries and issued a first report on creative industries in the year 1992 (MWMTV 1998). Since that time North Rhine- Westphalia has a high share of market leaders in the different sub-segments of creative industries and a big number of cities supporting creative industries. The federal state policy of North Rhine-Westphalia is still continuing and further developing, but it is supplemented by local initiatives and the German federal government policy. North Rhine-Westphalia for instance has launched a program “Creative.NRW” especially aiming at developing network partnerships, intensifying co-operation with regional institutions, strengthening of the location “North Rhine-Westphalia” for creative industries, enhancing regional ties to avoid movement of labor to competing locations, and promoting young academics and business start-ups.

Meanwhile every federal state in Germany has introduced specific initiatives or policies concerning creative industries, which lead to a strong competition between the stakeholders (MWEIMH 2012).

The German federal government has started the “initiative creative industries” in 2007. The initiative aims at establishing creative industries as growth sector and strengthening their competitiveness, carrying out an annually monitoring to receive reliable data, enhancing network within creative industries, informing about funding and financial support, (further) qualifying founders of creative industries enterprises, creating new funding possibilities or adapting existing ones to the needs of creative industries enterprises, facilitating access to bonded capital, adhering social insurance, especially for artists, and further developing digital copyright legislation to keep the balance between authors and users (GFMET 2010).

Already in the year 2009 guidelines for the generation of a homogenous statistical database for the creative economy in German federal states have been introduced, which is a prerequisite for a successful policy impact evaluation in the mid and long term (Söndermann 2009). Recently the German Federal Ministry of Economics and Technology has founded a “Centre of Excellence for the Cultural and Creative Industries”, which will support the implementation process of the above mentioned goals (GFMET 2013).

In the year 2011 the European Commission has published a staff working document on “Unlocking the potential of cultural and creative industries” (EC 2011). This paper reflects amongst others new strategies how to improve access of creative industries to funding. This does not only include ideas for new funding schemes, but also strategies for a better understanding of investors and creative industries executives, an improved investment readiness, new guarantee mechanisms to reduce the risks, a better support to micro-credit schemes, and greater use of venture capital (EC 2011).

4. KEY FACTORS FOR THE DEVELOPMENT OF CREATIVE INDUSTRIES IN GERMANY

Based on an empirical survey including responses of about 1,400 enterprises in the German creative industries sector Arndt et al. (2012) have discovered the following key factors affecting a successful development of creative industries in Germany by means of macro-economic analysis:

Success factors due to the own competence of actors of creative industries: 1. Consultation competence in order to overcome existing thought patterns and structures in the innovation process 2. Experience in dealing with social and “hidden” innovations 3. High communication and media competence Success factors in combination with enterprises of other sectors: 1. Detailed knowledge of potential user markets 2. Own self-understanding as a service provider 3. Competence in “emotionalizing” products and approaching the target group 4. Mutual respect among cooperation partners

The first group of success factors is mainly linked with specific competences of actors. However, especially the competence “to overcome existing thought patterns and structures in the innovation process” could be influenced by spatial structures, offered by different cities. Creative industries enhance their potentialities for innovation, when they are embedded in networks of different enterprises, scientific institutions etc., which is often realized in Science and Technology Parks. But also the second group of success factors is linked to the spatial and qualitative structure, fixed by urban planning decisions. The adjacency to enterprises of other sectors, to potential user markets or to service providers, which is typically offered within urban structures of Science Technology Parks may contribute to an increased contact, exchange and co-operation between those actors and – in the long term – may lead to more detailed knowledge of potential user markets, to a better self-understanding as service provider etc. (Oh 2013).

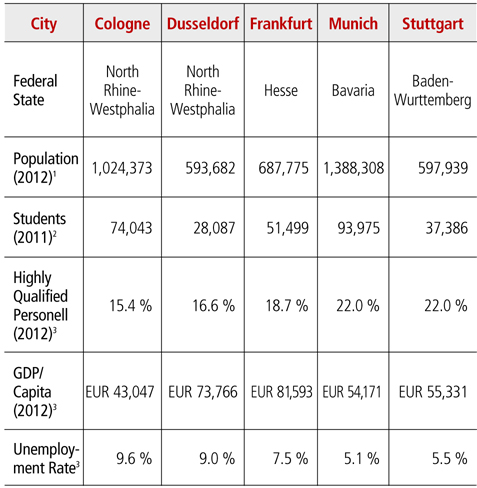

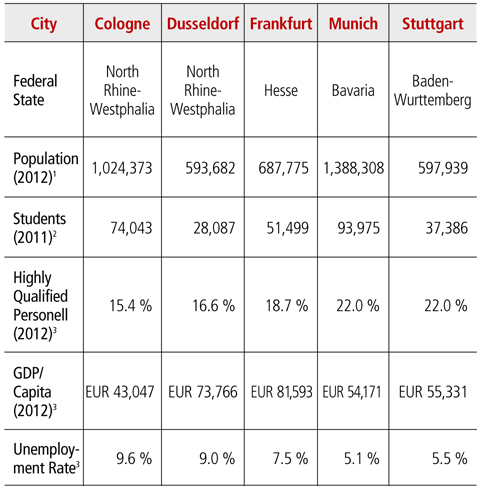

Obviously it is not a contingency that – with exception of Berlin – the most powerful German cities in creative industries offer these links to yet existing powerful branches, such as Cologne, Dusseldorf, Frankfurt, Stuttgart or Munich (Gottschalk et al. 2010, Creative.NRW 2011). <Fig. 6> presents the location of these cities within Germany, while <Table 1> summarizes their main characteristics, e.g. population as general information, number of students and share of highly qualified personnel as indicators for the innovation potential, and gross domestic product (GDP) per capita as well as unemployment rate as indicators for the economic power of the city. <Table 1> reveals that the number of students is very high in Munich, Cologne and Frankfurt, while Stuttgart and Munich is characterized by a high proportion of highly qualified personnel. GDP per capita is very high in Frankfurt and Dusseldorf, whereas Munich and Stuttgart do have a low unemployment rate, compared to other German cities.

[Table 1.] Main Characteristics of Most Powerful Cities in Creative Industries in Germany

Main Characteristics of Most Powerful Cities in Creative Industries in Germany

The above mentioned hypothesis – that powerful cities in creative industries offer links to yet existing powerful branches – may be supported from a regional perspective by MWEIMH (2012), which gives evidence that in the past years in North Rhine-Westphalia spatial clusters of highly developed creative industries have emerged, indicating strong positive interaction between creative industries and other powerful branches. Gottschalk et al. (2010) have mapped a creativity index for Germany, which points out six peaks in North Rhine-Westphalia: Aachen, Bonn, Cologne, Dusseldorf, Essen, and Munster, the six most competitive and successful cities within this federal state. Especially the new “Medion Technology Park” in Essen follows the concept of integrating creative industries, while Essen University delivers a new study program in creative industries. This indicates the future potential of Science and Technology Parks especially for creative industries.

Compared to other branches creative industries in Germany have developed very positively since the year 2000 and play a vital role as pioneer for a knowledge-based economy. This is mirrored in a labor force of nearly 1,000,000, an annual turnover of about €137 billion, and an annual gross value added of about €63 billion. Nevertheless, the turnover development in the sub-segments of creative industries in Germany from 2009 to 2011 was not homogenous. While the segments of software and games industry as well as performing arts market have developed very positively in terms of labor force and turnover, some segments, such as book market or press market have faced a negative development during the last years. That means driving forces of creative industries in the last few years in Germany have only been the subsegments of software and games industry as well as the performing arts market.

Creative industries are believed to possess strong innovation potentials and function as an important catalyst for innovations and knowledge-based growth in numerous other economic fields. For this reason creative industries are supported on federal governmental level, federal state level, and local community level by a broad range of different strategies and measures, including the development of partnerships, the promotion of young academics and business start-ups, the enhancement of regional ties to avoid movement of labor to competing locations, establishment of an annual monitoring to receive reliable data, the creation of new funding possibilities or adaptation of existing ones to the needs of creative industries enterprises, and others. However, there are still shortcomings indicating a lack of economic expertise, for instance concerning the communication between creative industries executives and investors, the investment readiness, the deficient use of venture capital, and others, which are limiting the future potential of creative industries especially with regard to Science and Technology Parks.

There are several key factors affecting a successful development of creative industries in Germany which can be grouped to success factors due to the own competence of actors of creative industries, and success factors in combination with enterprises of other sectors. Especially the competence “to overcome existing thought patterns and structures in the innovation process” – which is a part of the first factor – could be influenced by spatial structures, offered by different cities and could therefore be of relevance for the conception of Science and Technology Parks. But their main benefit is that they can create spatial and functional connections between enterprises of different sectors as well as to potential user markets or to service providers. These prerequisites, which are typically offered within urban structures of Science and Technology Parks may contribute to an increased contact, exchange and co-operation between those actors and – in the long term – may lead to more detailed knowledge of potential user markets, to a better self-understanding as service provider. That means Science and Technology Parks can have a very positive impact on the development of creative industries. This has been used and is still used in many German cities, especially in North Rhine-Westphalia under conditions of a needed structural change of the regional economy. However, in some German cities, like Munich, the positive role of Science and Technology Parks concerning their spatial and functional impact on the development of creative industries could be replaced by other factors, such as a vital urban structure within the inner city, characterized by a sound mixture of enterprises from different branches, which are spatially linked and therefore could benefit from networks, co-operation and mutual exchange.

That means in turn the immediate impact of Science and Technology Parks on creative industries could be improved, if we could methodologically separate the impacts of Science and Technology Parks on the one hand from the impact of other factors on the other hand on creative industries. This could lead to a better understanding how to efficiently improve the impacts of Science and Technology Parks on creative industries under specific conditions. On this basis, future financial support for creative industries could be improved, because the funding would be more goal-oriented and therefore more effective.