As one of the three major themes in the field of corporate finance, corporate investment has been widely concerned by the academic and practical fields. Financing constraint theory is often used to explain corporate investment behavior and investment efficiency (Fazzari, 1988). According to the theory of financing constraints, due to the inherent defects of the capital market, corporate investment is subject to its ability to raise external funds. When a corporation faces financing constraints, its investment expenditure will be sensitive to its ability to accumulate internal fund, that is to say, the more serious the financing constraint, the higher the investment-cash flow sensitivity (Love & Zicchino, 2006).

In order to alleviate financing constraints, more and more corporations are beginning to improve the information environment and are committed to improving information transparency to attract external stakeholders and decreasing cost of capital (Diamond & Verrecchia, 1991). As an important part of corporate non-financial information, corporate social responsibility information has stimulated more and more attention in academic and business field. Corporations with good social performance are often considered to be responsible citizens, with better image and higher customer recognition, thus having stronger ability to create cash flow in the future. Financial institutions such as banks are more willing to grant credits to them. By increasing disclosure of social responsibility information, corporations can reduce the uncertainty of future operations and ease financing constraints.

Financing constraint is an abstract concept and difficult to measure. Some scholars take the investment-cash flow sensitivity as a surrogate. If the investment-cash flow sensitivity reflects the degree of corporate financing constraints, then, what is the relationship between the investment-cash flow sensitivity and the level of corporate social responsibility disclosure? Are companies which disclose high-quality social information those which face severe financing constraints problems? These are questions that this paper tries to answer.

Taking China’s A-share listed companies between 2009 and 2016, this paper empirically tests the relationship between corporate social responsibility disclosure and investment-cash flow sensitivity by using Panel VAR model. Results show that: (1) the investment-cash flow sensitivity of firms with low level of CSRD is significantly lower than that of firms with high level of CSRD; (2) the orthogonal impulse response of corporate investment to cash flow in firms with high level of CSRD is significantly different from zero, but it is not significant in firms with low level of CSRD; (3) for firms with low level of CSRD, 0.7% of corporate investment volatility can be explained by the change in cash flow, while for firms with high level of CSRD, 1.1% of corporate investment volatility can be explained by the change in cash flow. That means, in order to alleviate financing constraints, firms facing severe financing constraints are more likely to increase social responsibility disclosure. Therefore, corporate social responsibility disclosure and financing constraints are positively correlated, leading to the positive relationship of CSRD and corporate investment-cash flow sensitivity.

This research may contribute in the following ways: Firstly, this research investigates the impact of financing constraints on corporate investment behavior from the perspective of corporate social responsibility disclosure, supplementing the extant literature in the field of corporate finance. Secondly, by testing the relationship between CSRD and corporate investment-cash flow sensitivity, this research indirectly demonstrates the relationship between CSRD and financing constraints, enriching the extant research on the motivation of corporate social responsibility disclosure. Finally, in the research method, we introduce the Panel VAR model and the orthogonal impulse response function to effectively distinguish the fundamental factors and financial factors which may affect corporate investment behavior, and better verify the chain of "CSRD - financing constraints - corporate investment", providing a new perspective for the research in social responsibility disclosure.

2. Literature, Theory and Hypothesis

With the increasing attention of the public to corporate social performance, more and more corporations have begun to issue standalone social responsibility reports. Research on the motivation and influencing factors of corporate social responsibility disclosure has attracted the attention of scholars from all over the world. Research results are emerging constantly.

Newson and Deegan (2002) use legitimacy theory to explain managers' decisions on social and environmental disclosure. He holds that the desire to legitimize an organization’s operations is in one of the many possible motivations in corporate social and environmental disclosures.

Orij (2010) uses a sample of 600 large firms from 22 countries to study the impact of national cultures on corporate social disclosure levels. The results do show that significant statistical relationships exist between corporate social disclosures and cultural measures.

Islam and Deegan (2010) employs a case study method to investigate the social and environmental disclosure practices of multi-national companies, specifically Nike and Hennes and Mauritz. Based on legitimacy theory and media agenda setting theory, they investigate the relationship between negative media attention and corporate social disclosure. Their results show that corporations react to negative media attention by providing positive social disclosure.

Fernandez-Feijoo, Romero, and Ruiz (2014) take a sample of firms from 11 countries which issued CSR reports registered in the GRI between 2008 and 2010. He investigates the factors affecting the disclosure behavior of firms and finds that firms listed in the stock market disclose more social information than private ones but with less credibility. European countries are leading in social disclosure and tend to have a cautious or leading attitude.

In addition to the above-mentioned literature from the perspective of institutional environment, some scholars studied corporate disclosure behavior from the perspective of the corporate inside. Cowen, Ferreri, and Parker (1987) hold that firm size, industry category and the existence of a corporate social responsibility committee are associated with certain types of disclosures. Said et al. (2009) holds that government ownership and audit committee are positively correlated with the level of corporate social disclosure. Giannarakis (2014) uses a sample of 100 firms from the Fortune 500 list for 2011 and investigates the relationship between corporate governance, financial characteristic and the extent of corporate social disclosure. The results indicate that firm size, the board commitment to CSR and profitability are positively correlated with the level of CSR disclosure, while financial leverage is negatively correlated with the level of CSR disclosure.

Still many scholars have studied corporate social responsibility disclosure from the perspective of information users. Roberts (1992) investigates the determinants of corporate social responsibility disclosure from the perspective of stakeholder theory. He reviewed 12 mining corporate reports which referenced Global Reporting Initiative (GRI) guidelines and found that measure of stakeholder power, strategic posture and economic performance are significantly correlated with the level of CSR disclosure. Gunawan (2015) investigates the stakeholders’ influences on corporate social responsibility disclosure of Indonesian firms by distributing a questionnaire to 252 upper level of management. The findings show that “community” is the most salient stakeholder group that influences the practice of CSD. Corporate disclose social responsibility information mainly to “create a positive image”.

Unlike developed markets such as the United States, China is a developing country with transitional economy. Firms, especially private firms, are always faced with severe financing constraints. The weak legal system and strong government intervention make corporate voluntary disclosure become a tool to gain government support and credits of loaners. Due to the financing constraints caused by imperfect capital markets and information asymmetry, firms may disclose voluntary information to improve corporate transparency. As an important part of non-financial information, corporate social responsibility information has attracted more and more attention of stakeholders. Firms with good social responsibility performance are often regarded as responsible citizens, with better image and reputation, higher customer recognition, and potentially stronger profitability in the future. So it is easier for them to raise money from outside. When firms face severe financing constraints, they will have greater incentives and pressure to disclose social responsibility information, signaling to the stakeholders their responsible corporate images. At the same time, the investment activities of firms which face severe financing constraints may be more constrained to their abilities to generate cash flow. So the higher the disclosure of social responsibility information, the more sensitive corporate investment is to cash flow. Considering this, we put forward the following hypothesis:

H: Compared with firms with low level of social responsibility disclosure, firms with high level of social responsibility disclosure have higher investment-cash flow sensitivity.

3.1. Data Source and Sample Screening

As the main variable of this paper, corporate social responsibility disclosure data was released in Run Ling Global Corporate Social Responsibility Rating Database from the year 2009. This research takes China’s A-share listed companies whose stocks traded after 2009 as a sample. Our sample period is between 2009 and 2016. The sample screening process is as follows: (1) Excluding financial listed firms and ST (Special Treatment) firms; (2) To avoid the impact of mergers and acquisitions as well as restructuring on the research results, firms with a total asset growth rate greater than 150% are excluded; (3) Excluding firms that issue B shares or H shares

*The stocks of listed companies in China can be divided into several groups, i.e. A shares, B shares, H shares etc. This distinction is based primarily on the location of the stock and the investors it faces. To avoid the systematic differences in A shares B shares H shares, we excluded B shares or H shares firms. **The CSMAR Economic and Financial Research Database is a professional database in China, drawing on the professional standards of the University of Chicago CRSP, Standard & Poor's Compustat, NYSE TAQ, I/B/E/S, Thomson and other internationally renowned databases, combined with the actual situation in China.

Our research is divided into two steps: First, we use the Panel VAR model to estimate the investment equation, cash flow equation and sales equation, and then use the orthogonal impulse response function to analyze the differences in investment-cash flow sensitivity between firms with different levels of corporate social responsibility disclosure. The main benefit of using the Panel VAR model is its effectiveness in avoiding endogeneity between variables. The model design is as follows:

Among them, yit is a vector consisting of corporate investment expenditure (IKB), sales (SKB) and cash flow (CFKB). SKB reflects the impact of the fundamental factors on corporate investment spending. CFKB reflects the impact of financial factors on corporate investment spending. φi is a fixed effect, and ωt is a time effect (Love, 2006). In order to better reflect the relationship among corporate investment expenditure, sales and cash flow, we remove the fixed effect and time effect by Forward Mean Difference Method and Intra-Group Mean Difference Method, and then use GMM to obtain the consistent estimator of β1. If corporate social responsibility disclosure is driven by financing constraints, the investment-cash flow sensitivity of high-quality CSRD corporates is expected to be higher than that of low-quality CSRD corporates. That is to say, the value of β1 of high-quality CSRD corporates is expected to be significantly greater than that of low-quality CSRD corporates. The definitions of the main variables in this paper are shown in Table 1.

[Table 1:] Definitions of Major Variables

Definitions of Major Variables

[Table 2:] Descriptive Statistics of Major Variables

Descriptive Statistics of Major Variables

[Table 3:] Lag Order Screening Results

Lag Order Screening Results

Table 2 reports descriptive statistics of the main variables in this paper. In order to test the relationship among CSRD, corporate investment, sales and cash flow, we divide the sample firms into two groups according to the median of CSRD: Low-disclosure and High-disclosure. As can be seen from the table, the values of SKB, CFKB and IKB of Low-disclosure group are lower than that of High-disclosure group. That is to say, firms which disclosed more social responsibility information tend to be firms with more sales revenues, more cash flows and more investment expenditures. Firms disclose higher quality CSRD mainly to alleviate financing constraints and meet investment demands.

Before GMM estimation, we use the AIC criterion, BIC criterion and HQIC criterion to screen the lag order of the model. The results are shown in Table 3. As can be seen from this table, the lag order is significant in the first period for both full sample and grouped samples. Therefore, we choose one-period lag for GMM estimation. GMM estimation results are shown in Table 4. As the object of this paper is the investment-cash flow sensitivity, in Table 4, we mainly focus on the coefficient of cash flow (L.h_CFKB) with one lag in the investment equation. The coefficient of L.h_CFKB in the full sample is 0.042, which is significant at the level of 1%. That is, cash flow with one-period lag has a significant impact on corporate investment. The coefficient of L.h_CFKB in Low-disclosure group is 0.037, which is lower than that in High-disclosure group (0.049). It means that the investment expenditure of firms with higher level of CSRD is more sensitive to cash flow than that of firms with lower level of CSRD, supporting the hypothesis put forward above.

4.3. Results of Orthogonal Impulse Response

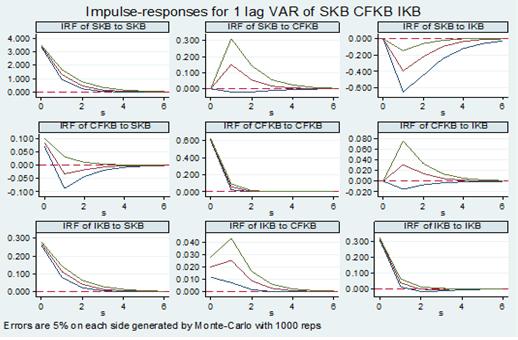

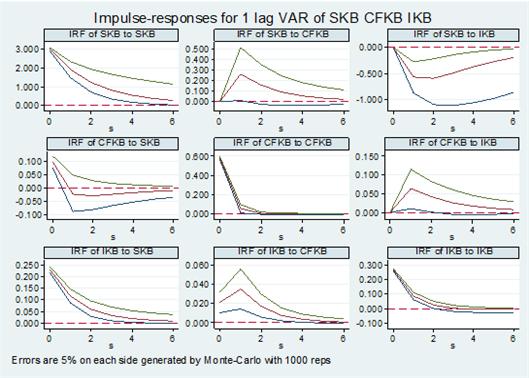

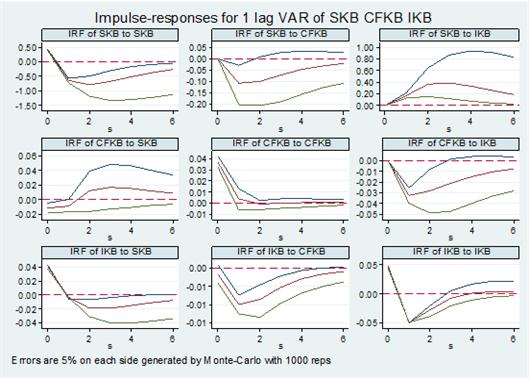

Fig. 1–3 report the orthogonal impact response functions of the VAR model with one-period lag of Low-disclosure group, High-disclosure group and the differences of the two samples respectively. In all of the three figures, our focus is on the impact of fluctuations in corporate cash flow on future investment (i.e. IRF of CFKB to IKB). In Fig. 1 we can see that, for corporates with lower level of CSRD, when a shock causes the corporate cash flow to fluctuate, its investment expenditure is not significantly affected. Fig.2 shows that for corporates with higher level of CSRD, when a shock causes the corporate cash flow to fluctuate, its investment expenditure will change significantly in the first period lag. Fig. 3 reports the results of the orthogonal impact response of the differences between the two groups. The orthogonal impact response is significant in both one-period lag and two-period lag. Therefore, the results of Fig. 1-3 support the hypothesis that corporate investment- cash flow sensitivity in High-disclosure group is higher than that in Low-disclosure group.

[Table 4:] Regression results of PVAR Model

Regression results of PVAR Model

In order to better explain the differences of impacts of cash flow on corporate investment between firms with different levels of CSRD, we perform variance decomposition for different types of firms separately. The results of variance decomposition are shown in Table 5. It can be seen from Panel A that for low-disclosure group, 51.4% of corporate investment volatility can be explained by the investment expenditure itself, with 47.9% explained by the change in sales, and 0.7% explained by the change in cash flow. Panel B shows that for high-disclosure group, 50.8% of corporate investment volatility can be explained by the investment expenditure itself, with 48.1% explained by the change in sales, and 1.1% explained by the change in cash flow, which is 0.4% greater than that of the low-disclosure group. Therefore, compared with that of low-disclosure firms, the investment expenditure of high-disclosure firms are more sensitive to cash flow, which means that high-disclosure firms are firms with more severe financing constraints.

[Table 5:] Variance Decomposition Results

Variance Decomposition Results

This paper employs the Panel VAR model to test the relationship between corporate social responsibility disclosure and investment-cash flow sensitivity, using a sample of China’s A-share listed companies between 2009 and 2016. The results show that significant differences exist in the investment-cash flow sensitivity among firms with different levels of CSRD. The investment-cash flow sensitivity of firms with low level of CSRD is significantly lower than that of firms with high level of CSRD. The orthogonal impulse response of investment expenditure to cash flow volatility of firms with high level of CSRD is significantly different from 0, while for firms with low level of CSRD, the orthogonal impulse response is not significantly different from 0. 1.1% of the investment expenditure fluctuation can be explained by cash flow for firms with high level of CSRD, but only 0.7% can be explained by cash flow for firms with low level of CSRD. As the investment-cash flow sensitivity means the seriousness of the financing constraints, the conclusion of this research indicates that firms with high level of CSRD may face more serious financing constraints, that is to say, firms disclose high-quality social responsibility information in order to ease their financing constraints and information asymmetry.

The findings of this research have certain implications: Firstly, results show that companies disclose high-quality social responsibility information not only out of the needs of institutional isomorphism or the pressure of legitimacy, but also in view of economic concern. To alleviate information asymmetry, decrease financing costs and finally to obtain bank credit and investors’ concern, a company may choose to disclose voluntarily high-quality information. Thus, regulating the financial market in developing countries by introducing market mechanisms and free competition will help improve the information environment of developing countries. Secondly, policy-makers should formulate laws and policies to guide firms in social responsibility disclosure. High-quality CSRD can not only meet the information needs of stakeholders, but also effectively relieve the financing constraints of companies and promote the healthy development of capital market.

This research has some limits: Firstly, this research is based only on the theory of financing constraints, and it ignores the role of agency theory in explaining corporate investment behavior. Secondly, as a transitional economy, China faces a unique political and economic environment. The results of this research should not be generalized as the sample was based on Chinese firms between 2009 and 2016. Future research can investigate the relationship between CSRD and financing constraints in different institutional environments.