The Korean cosmetic market has changed remarkably and has grown as a major competitive market in the world market. In particular, the Korean cosmetic market has enjoyed a golden period of rapid growth in recent decades. This is considered possible due to the development of the distribution structure and the emergence of new brands. Distribution channels have played a very important role in the development of the domestic cosmetic market. The cosmetic market has grown with the core channels that lead the market from time to time. These core channels have changed over time. Door-to-door sales enjoyed the golden age of the cosmetic market in the 1980s, and the discount mart channel appeared in the 1990s. In 2000, one-brand stores with low price led the growth of the overall cosmetic market. The development of the Korean cosmetic market was driven by evolving distribution channels. Consumers' information searching process as buying behavior changes as the retailing environment changes (Puccinelli, Goodstein, Grewal, Price, Raghubir, & Stewart, 2009). Analysis of changes in the distribution structure of cosmetics is not only important for understanding the market and foreseeing future prospects but also for understanding the Korean cosmetic market that is experiencing rapid growth and change.

It is interesting to note that the recent rapid growth of the Korean cosmetic market shows a dynamic change with the emergence of new and diverse competitors. The emergence and growth of competitive new companies, along with existing firms, intensified competition in the market, which developed the domestic cosmetic market. The development of various new brands in the Korean cosmetic market has enabled the advancement of the cosmetic production base. Currently, many companies in the domestic market do not produce cosmetic directly, but manufacture products through original equipment manufacturing (OEM) and original design manufacturing (ODM). The development of outsourcing companies with superior technology and know-how has resulted in a dynamic structural change throughout the market ecosystem, lowering barriers to high market entry and creating diverse values.

The purpose of this study is to analyze the changes in the domestic cosmetic market in recent rapid growth and change. In particular, existing previous studies on the domestic cosmetic market mainly dealt with the market of the 1940s and early 2000s (Lee, Kim, & Song, 2009). However, this study focuses on the changes since 2000, when the Korean cosmetic industry has grown rapidly, and analyzes the changes in their sales and distribution structure, mainly from cosmetic companies that have led the market changes. In recent years, the cosmetics market has been driven by cosmetic companies that have driven these market changes and the growth and decline of these companies is thought to be deeply related to major distribution channels. The core distribution channels that are driving the growth of the cosmetic market in recent years are the on-line market and brand stores. This study analyzed the market changes centering on off-line brand stores. Brand stores are divided into a one-brand store operated by a cosmetic brand alone and a multi-brand store dealing with various brands. In the early 2000s, the distribution channels that led the growth of the domestic cosmetic market were low priced one-brand stores. However, consumers' preference for multi-brand stores that can compare brands together is increasing recently. Therefore, this study compared and analyzed the performance of cosmetic brands centering on two distribution channels, one-brand store and multi-brand store.

2.1. Studies on Korean Cosmetic Distribution Channel

Factors affecting consumer's purchase of cosmetics are product efficacy, brand, price, service and design (Kim & Lee, 2016). However, with the recent increase in low-cost and high-quality cosmetics, the importance of distribution channels is increasing. Previous studies on cosmetic distribution channels can be analyzed in two aspects. First, there are studies that classify cosmetic distribution channels by period and analyze their characteristics and changes. Lee et al. (2009) studied the current state of the market from the 1940s to the 1990s. Another flow of research on the cosmetic distribution channel focused on diagnosing the current status and problems of the distribution channel, and suggesting enhanced competitiveness and desirable directions. Lee (2007) focused on market size, features, problems and improvement strategies by channel. Lee & Hwang’s (2010) study focused on consumer preference for low-price, one-brand stores and analyzed the causes. As mentioned above, previous studies have argued that the Korean cosmetic market has recently shifted from the manufacturer center to the consumer center due to the development of the cosmetic distribution channel. From a corporate perspective, the ability to develop products was important in the past, but now it is important to have a distribution capacity that meets consumer expectations and creates and delivers value.

2.2. Studies on the Changing Process of Korean Cosmetic Market

As mentioned above, the development of the cosmetic market is closely related to changes in the main distribution channels. Therefore, many previous studies have examined the changes and characteristics of distribution structure by period. Similarly, this study analyzed the recent changes while confirming these changes by period. First of all, based on the previous studies, the distribution channels of the Korean cosmetic industry in the 1950s had few specialized stores dealing only with cosmetics of manufacturers. Thus, the market was centered on conventional wholesalers or retailers dealing with them. At that time, smuggled foreign cosmetics constituted major products on the market and the basis for cosmetic production was weak. In the 1960s, the number of smuggled cosmetics increased, and the cosmetics market grew in size with manufacturers appearing to mimic products made overseas. The government increased the number of cosmetic manufacturers to protect and foster the industry, but because of its weak distribution structure, wholesalers with power in the market severely abused tyranny (Lee et al., 2009).

In order to improve this structure and supply products to consumers stably, manufacturers introduced a new distribution channel, door-to-door. Since the door sales channel appeared in 1964, it has led the market as the most important channel. Lee et al. (2009) studied door-to-door sales and found that a variety of service offerings and high-quality door-to-door products led to its successful settlement.

By the late 1980s, general cosmetics shops had grown in a new distribution channel. According to a study by Lee et al. (2009), this change was caused by the increase in household incomes due to economic development and the expansion of women's social entry, and the pursuit of rational consumption by consumers.

Comprehensive cosmetics shops have evolved into the current cosmetics shop in the 1990s. In 1997, cosmetics shops grew to 55% of the total market, becoming a large distribution channel that surpassed the door-to-door sales channel. The growth of this cosmetics specialty channel was possible due to price discounts, various product configurations, and excellent accessibility. However, price competition has been intensified among cosmetics shops since the late 1990s (Lee et al., 2009). This situation caused consumers to disbelieve excessive price discounts, and diversified their needs and led to the pursuit of individuality, leading to a decline in the share of specialty stores and slowing growth. Furthermore, with the IMF, the market has become more polarized, with price-sensitive consumers and quality-priority consumers. Cosmetics stores have declined as large discount stores, hypermarkets, and pharmacies emerge as new cosmetic distribution channels (Lee et al., 2009). Since 1998, large discount stores that combine inexpensive daily necessities and sales methods similar to specialty stores have grown into cosmetic distribution channels. The growth of large discount store channels continued until 2001, but with the introduction of new distribution channels in 2002, large discount store channels lost their competitiveness in the market. In 2002, Able C & C launched ‘Missha’ and tried a new distribution method called "Low Price One-Brand Store." Since then, many low-cost one-brand stores, such as ‘The face shop’ (2003) and ‘Skin food’ (2004), have emerged, driving the market's growth. Since 2005, the size of the market has been further expanded by the participation of large cosmetics companies. By 2014, the cosmetics market changed again. The center of the market has moved from a one-brand store to a multi-brand store. Amid the changes and trends in the cosmetics market, this study focuses on the distribution channels of the cosmetics market since 2002 and analyzes the causes and implications of the changes.

[Table 1:] The Changes in Korean Cosmetic Market by Time Period

The Changes in Korean Cosmetic Market by Time Period

3. Review of Korean Cosmetic Market Changes

3.1. Growth and Structural Changes in the Domestic Cosmetics Market

The domestic cosmetic market grew dramatically in the 2000s. According to the health industry statistics analyzed by the Korea Health Industry Development Institute, the domestic cosmetic market, excluding overseas market areas, is over 10 trillion won in 2018. <Table 2> shows the domestic cosmetic market analysis based on statistics from Korea Health Industry Development Institute. Using this data, the market size change showed that the total market size for 2018 grew nearly three times compared to 2001. In particular, the market of about 4 trillion won has grown rapidly since 2007, reaching 8 trillion won in 2013 and 10 trillion won in 2018.

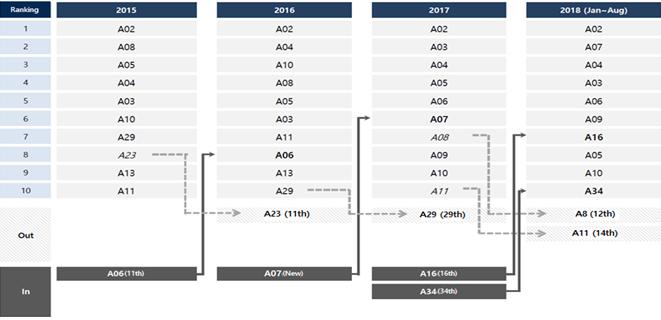

The Korean cosmetic market changed and grew as competitive large companies emerged in the cosmetic market, which showed a great change in terms of market structure. In the course of this change, existing brands declined, while new brands with great success were born. This market change is also confirmed through the change in the sales rank of trading company K, the leading cosmetic ODM company. In 2016, only 26.5% of domestic brands produced their own brands in the total cosmetics market, and most mid-sized cosmetics brands rely solely on out-source production (Korea Trade Insurance Corporation, 2018). Therefore, the volume of transactions with cosmetic ODM companies is an important indicator to analyze the market sales of the cosmetic brand. Data on K-company's sales rankings for each of its clients over the last four years can be found in <Figure 1>. This figure shows that A08, the second largest trading company in 2015, is rapidly falling to 4th place in 2016, 7th place in 2017, and 12th place in 2018. In addition, A23, which was 8th in 2015, fell to 11th in 2016, and A29, which was 10th in 2016, fell to 29th in 2017. As such, there are frequent cases where companies that have been successful in the existing market gradually lose their competitiveness.

[Table 2:] Changes of the domestic cosmetics industrial scale since 2000

Changes of the domestic cosmetics industrial scale since 2000

On the other hand, there have been a number of companies that have raised their positions in the market or entered the top 10. A06, which was 11th in 2015, was 8th in 2016 and 5th after 2017. A16 company grew from 16th in 2017 to 7th in 2018, and A34, which was 34th in 2017, grew rapidly to 10th place in the first half of 2018.

Company K's sales data does not represent the market as a whole. However, the recent rapid change shows that the domestic cosmetics market is changing dynamically. According to K's internal analysis, the change in distribution structure has had a big impact on the change in sales rank. In other words, the growth of new channels and the cosmetics companies that operate with a focus on those channels are growing significantly in the market.

Therefore, this study examines the specific growth and decline of cosmetic brands in the market through the company's disclosure information and confirms the relationship between the changes in the market position of these brands and the competitiveness of cosmetic distribution channels.

3.2. Changes in Cosmetic Brands Sales Trend by Distribution Channel Type

This study analyzed the structural changes in the domestic cosmetics market since 2000, and confirmed the change in sales of mid-size cosmetic companies. Large companies such as ‘Amore Pacific’ and ‘LG Household & Health Care’ have been excluded because they are not related to the recent structural changes in the domestic cosmetics market because they have maintained their competitiveness in the market. However, companies included in affiliates of large corporations, but independent corporate firms such as ‘Innisfree’ and ‘Etude House’, were included in this study because they were related to the subject of this study.

[Table 3:] Cosmetic Brand Sales by Distribution Channel in Korea

Cosmetic Brand Sales by Distribution Channel in Korea

In particular, this study classified and analyzed the sales of each company, focusing on the main distribution channels. The purpose of this distinction is to identify how changes in channel competitiveness relate to changes in the market position of each company. In other words, it is necessary to identify the reason why the competitiveness of the channel has changed-launching a new brand, growing a specific brand, changing the competitiveness of the distribution channel itself.

The sales of cosmetic brands were used based on the sales amount disclosed in the corporate audit report of the Korean Data Analysis, Retrieval and Transfer System (dart.fss.or.kr). In the case of unlisted companies that are missing information or whose information is not disclosed in the disclosure system, the sales data were from the company's homepage or the news article. Etude House opened in 2005 as a one-brand store. Therefore, previous sales were not included in the study analysis. The one-brand store channel brands to be studied were 'Innisfree', 'The face shop', 'Able C & C (Missha)', 'It's Hanbul', 'Etude House', 'Nature Republic', 'The Saem' and 'TONYMOLY'. Multi-brand store channel brands are 'Aekyung', 'Atomy', 'Carver Korea (AHC)', 'Have & Be (Dr.Jart)', 'L & P Cosmetic (Mediheal)', 'Costory (Paparecipe)', 'Clio' , 'Leaders Cometics', 'Jayjun', 'Cosmocos', 'GPClub', 'Too cool for school', 'People & Co', 'Maiim', 'INEL Cosmetics' and 'Nanda (3CE)'.

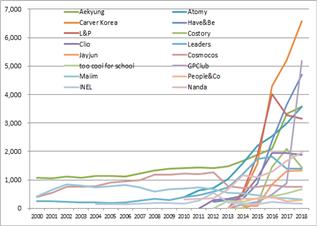

In <Table 3>, the sales of domestic cosmetic brands from 2000 to 2018 are summarized. Through this, it is possible to confirm the growth and decline of domestic cosmetic brands and the entry timing of new brands. In the 2000s, a number of new brands appeared on the market and they grew significantly. Also, as shown in <Figure 2> and <Figure 3>, brand sales for each channel are similar to that of the overall channel and brand. As the distribution channel became more competitive, the company's entry into new brands increased, and sales by brand grew overall. In the case of multi-brand store channels, the entire market exploded with the introduction of five new companies in 2014, but since 2017, the popularity of one-brand store channels has declined and sales of all brands in the channel have also declined. This can be seen that sales of each cosmetic company changes closely related to the competitiveness of distribution channels.

3.3. Recent Change of Cosmetics Distribution Structure

Spiggle and Sewall (1987) argued that store and consumer characteristics influence consumer choice of stores. And it is important to understand the consumers' channel preferences to manage multiple channels successfully and store image can make a difference in their performance (Hildebrandt, 1988; Gensler, Dekimpe, & Skiera, 2007). Therefore, this study aims to analyze the change process of the domestic cosmetic market focusing on the change of distribution channels. The rapid change in the domestic cosmetic market began in 2002 and the changes in distribution channels can be divided into four stages as shown in <Figure 4>. The first stage is the emergence of low-price one-brand stores in the existing market, the second stage is the rapid growth of one-brand store channels, and the third is the rapid growth stage of multi-brand store channels. And the fourth stage is the decline of one-brand stores, which were the main distribution channels in the domestic cosmetic market.

3.3.1. Appearance of one-brand store (2002~2007)

A one-brand store first appeared in 2002. Able C & C opened ‘Missha’ brand store in 2002, pioneering a one-brand store channel and opened a new era in the cosmetic market with reasonable prices, high quality and comfortable access to consumers. Since IMF, consumers' rational purchasing preferences have led to the growth of the cosmetic market through large discount channels as a way of daily necessities. 'Missha' not only attracted consumers' attention with reliable quality products and low prices in the market, but also gave consumers a different experience than ever before. In the process, ‘Missha’ achieved over 100 billion won sales in three years since entering the market in 2004. The success of ‘Missha’has led to the emergence of a number of one-brand stores. In 2004, 'The face shop' entered the market and recorded sales of more than 150 billion won in two years. 'Etude House' and 'Innisfree' appeared in the cosmetic market in 2005 and 2006.

3.3.2. Growth of one-brand store (2008 ~ 2012)

The one-brand store channel, which started as Able C & C's ‘Missha’, later became the core channel with ‘The face shop’, ‘Etude House’ and ‘Innisfree’. ‘Missha’ achieved phenomenal growth in 2009 and 2011, with more than 400 billion won in sales, with multiple hit products. Many latecomers also grew together, leading the domestic cosmetic market. The success of this one-brand store channel has fueled the continued emergence of new brands. ‘Nature Republic’ and ‘TONYMOLY’ in 2009, ‘The Saem’ in 2010, and ‘It's Hanbul’ in 2011 have been very successful. The key to the success of this one-brand store channel is reasonable pricing, reliable product power, and advertising, with a variety of promotional activities, a wide distribution network, and accessibility. Park's (2015) study concluded that during this period, the influence of Korean Wave dramas centered on the Asian market, which led to an increase in Korean cosmetics exports. For this reason, the purchase of foreign tourists in China, Japan and Southeast Asia also affected the market growth during this period.

3.3.3. Growth of multi-brand store (2013 ~ 2016)

Multi-brand stores are a cosmetic distribution channel that handles a variety of branded products, and are similar to the general cosmetic stores that appeared in the late 1970s. However, these independent specialty cosmetic stores gradually disappeared by the expansion of the hypermarket cosmetic market in the 2000s. Since then, the 'Health and Beauty store' (hereinafter referred to as the H&B store) has grown in the multi-brand store style. Currently, multi-brand store channels exist in various forms, but the core type among them is H&B store, which was started by CJ's “Olive Young” in 1999. ‘GS Watsons’, which was established in 2005 as a joint venture by GS Retail’ and Hong Kong Watsons, was launched. The channel's full-fledged growth began with aggressive store expansion by ‘Olive Young’. This period coincides with the appearance of LOHB's. GS Watsons broke up with Hong Kong Watsons in 2018 and changed its brand name to ‘Lalavla’ and tried to strengthen its competitiveness in the market.

The multi-brand store channel has grown with cosmetic companies that use this channel as their primary tool. Among those companies, Carver Korea, Have & Be, L & P Cosmetic, Costory, and Jayjun have grown significantly. Carver Korea, AHC's parent company, saw its sales grow significantly from 156.5 billion won to 428.9 billion won in 2016 and 520.1 billion won in 2017. Have & Be's sales increased from 86.3 billion won in 2015 to 237.2 billion won in 2016 and 362.8 billion won in 2017. 'Nanda' of 'Style Nanda' entered 3CE (3 concept eyes) into the cosmetic market in 2009, and achieved sales of more than 100 billion won in 2014, Moreover, ‘Nanda’ received 600 billion won from L'Oreal Group on handing over shares, and showed the company its value to the world.

Mediheal's parent company, L & P Cosmetic, achieved revenues of 188.8 billion won in 2015, and grew to 401,5 billion won in 2016. The sales of Costory was 16 billion in 2015, but grew to 145,2 billion won in 2016 and 213,6 billion won in 2017. Jayjun also saw its business grow from 8 billion won in 2015 to 83.4 billion won in 2016 and 127,9 billion won in 2017. In addition to these brands, the sales of Clio, too cool for school and GPClub, which focus on multi-brand store channels, also increased significantly. This period was that the domestic cosmetic market grew overall, as well as a multi-brand store channel. As a result, the market size grew significantly. This period can also be seen as the golden age of off-line cosmetic stores called "road shops." The success of these channels is what differentiates them from traditional cosmetic brands, such as reliable quality products, reasonable prices, various promotions, and customers’ in-store experience.

3.3.4. Decline of one-brand store (After 2017)

Since 2017, multi-brand store channels have continued to grow in the market, while one-brand store channels have lost sales since 2017. ‘Missha’ and ‘Etude House’, which have continued to grow in the cosmetics market, saw their first decline in 2015, while in 2016 ‘it's Hanbul’ and ‘Nature Republic’ saw a slight decline. As a result, the overall sales of all one-brand store channels decreased in 2017. This contrasts with the continued growth of brands that focus on multi-brand store channels. Multi-brand store channels have provided consumers with a number of benefits that they can compare with a variety of new products and that one-brand store channels do not offer. In 2017, multi-brand store channels outperformed one-brand store channels in total sales by channel. This change in structure is related to changes in the consumer's buying behavior of cosmetics, so it is considered that there is little possibility of a temporary phenomenon.

Consumers prioritize diversity, topicality and pleasant experiences in the current cosmetics market. Changes in communication styles, such as the growth of SNSs and the sharing of experiences, have further strengthened the preference for multi-brand store channels where consumers can meet a variety of hot items with a pleasant experience. Furthermore, H&B stores are gradually evolving into convenience stores, selling cosmetics and other daily necessities. Rather than visiting the H&B store to buy cosmetics only, consumers are likely to buy simple meals, beverages, and daily necessities, thus, the growth potential is expected to be even higher than before.

This study analyzed Korean cosmetic market in the 2000s, showing rapid growth and change. Since 2000, the emergence of domestic cosmetic companies and their changes in sales have been analyzed, and their growth and decline has been confirmed depending on the type of distribution channel. As a result, the change in sales of the entire channel and the sales of each brand were very similar. In other words, brands on the same channel showed that companies grew or declined as the competitiveness of the channels changed, rather than the zero sum competition such as competing with each other and taking advantage of the other. These findings show that sales of cosmetic companies are closely linked to the competitiveness of distribution channels.

In addition, this study divided and analyzed the process of changing the domestic cosmetics market into the four stages since the 2000s. : the emergence of a single brand, the growth of a single brand channel, the growth of a multi-brand channel, and the decline of a one-brand channel. Recently, the domestic off-line cosmetic market has centered on one-brand store channels and multi-brand store channels. However, the competitiveness of one-brand store channels has declined over the past three years, and the market is reorganizing around multi-brand store channels. The decline of the one-brand store channel is also due to a combination of growth, such as on-line market growth and a decline in Chinese tourists. However, the weakness of the channel itself is considered to be the biggest reason for the decline. Since consumption trends in the market change rapidly, consumers' choices determine channel success and decline. As consumer lifestyles change and their value through shopping changes, so does the value of cosmetic distribution. Consumers' recent buying behavior of cosmetics is not just an exchange but an experiential activity that enjoys the purchase process itself. Therefore, because consumers seek knowledge, fun, convenience, and reasonable prices when purchasing cosmetics (Nguyen, & Vo, 2019; Bae, Kim, & Oh, 2019), distribution channels that provide a variety of product experiences and a pleasant and convenient store experience are the market choices (Lee & Hwang, 2010). In today's market, where the competitive advantage over the product itself is fading away, the limited consumption experience offered by a one-brand store is no longer attractive. Multi-brand stores, which allow consumers to compare and purchase products of various brands more conveniently and interestingly, can meet the needs of consumers and are likely to continue to grow in the future. In terms of corporate management, the way of selling products in multi-brand stores has a lower risk level and has procedural advantages than building a unique distribution structure in a one-brand store. Thus, it has become a more competitive alternative. Recently growing multi-brand channel cosmetic companies are making strategic efforts to communicate their consumers to the market using communication channels and tools in innovative ways, rather than designing cosmetic manufacturing or distribution channels. Given these circumstances, the outlook for multi-brand store channels seems to be brighter.

Nowadays the growth of traditional channels such as department stores, marts and brand stores has slowed in the global cosmetics distribution channels, but multi-brand and on-line channels are growing. In particular, global multi-brand stores such as ‘Sephora’ and ‘Boots’ are growing rapidly in recent years, and domestic one-brand store channels are planning to change in line with such changes. Able C & C, a leading company in a one-brand store channel, has recently begun to reorganize its distribution network around a multi-brand store called 'NUNC'. It is changing to the form of an editorial store dealing with other companies' products.

This study has the following implications. First, the Korean cosmetics market, which is changing dynamically with the recent growth, is considered in terms of distribution structure. In particular, the emergence and growth of mid-sized cosmetic companies, which are leading the cosmetic market, are analyzed with the change in distribution structure. In addition, this study suggests that the distribution structure of cosmetics is changing from a one-brand store to a multi-brand store, and analyzes the changes in the value of cosmetics pursuit of the consumers that caused these changes.

This study has the following implications academically. First, this study focused on the cosmetics market since the 2000s, which was not covered in previous studies. The development process of that period was divided into four stages and its characteristics were examined. Second, it is significant in analyzing the causes of changes in Korean cosmetics companies and their distribution structure, and suggesting directions for further research.

4.2. Limitations and Future Research

This study used the sales information of companies to analyze the structural changes in the cosmetics market. This approach is adequate to account for external changes in the market but is limited in explaining the internal causes of those changes. This study did not clarify the reasons for considering the consumer's point of view in the cause analysis of the distribution channel that grows or declines in the cosmetics market. Considering the limitations of this study as an exploratory study, it is expected that further procedurally strict studies are needed. Therefore, as future research is conducted on the consumers of the cosmetics market, the causes of growth and decline of cosmetic brands and changes in distribution structure need to be analyzed more closely.